Embark on a journey into the future of car insurance rates in 2025, exploring the key factors shaping the landscape and the tools available to make informed decisions. Discover how advancements in technology and the rise of autonomous vehicles will impact insurance premiums, and learn strategies for negotiating competitive rates.

Factors to Consider When Comparing Car Insurance Rates in 2025

In 2025, several key factors will play a crucial role in determining car insurance rates. Advancements in technology and the increasing use of data analytics will significantly impact how insurance premiums are calculated.

Advancements in Technology

Technological innovations such as telematics devices, autonomous vehicles, and artificial intelligence will have a profound effect on car insurance rates in 2025. Telematics devices, which track driving behavior, will allow insurance companies to offer personalized premiums based on individual driving habits.

Autonomous vehicles may lead to a decrease in accidents, resulting in lower insurance rates for these vehicles. Additionally, artificial intelligence will streamline the claim process and improve risk assessment, potentially leading to more accurate pricing.

Role of Data Analytics

Data analytics will continue to be a driving force behind the determination of insurance premiums in 2025. Insurers will increasingly rely on sophisticated algorithms to analyze vast amounts of data related to factors such as driving history, location, and vehicle characteristics.

By leveraging data analytics, insurance companies can more accurately assess risk and set premiums accordingly. This data-driven approach will result in more customized policies and pricing for consumers.

Utilizing Online Tools for Comparing Car Insurance Rates

In today's digital age, comparing car insurance rates has become more convenient and efficient thanks to the availability of various online tools. These tools offer a quick and easy way to compare different insurance options and find the best rates that suit your needs and budget.

Overview of Online Tools

There are several online platforms that provide services for comparing car insurance rates. Some popular options include:

- Insurance comparison websites: These platforms allow you to input your information once and receive quotes from multiple insurance companies.

- Insurance company websites: Many insurance providers offer online tools on their websites that allow you to get quotes and compare their rates.

- Mobile apps: Some insurance companies have developed mobile apps that make it easy to compare rates on the go.

Comparing Features of Online Platforms

When choosing an online tool for comparing car insurance rates, it's essential to consider the features each platform offers. Some key factors to compare include:

- Ease of use: Look for platforms that are user-friendly and easy to navigate.

- Coverage options: Ensure that the platform provides information on different coverage options available.

- Customization: Choose a tool that allows you to tailor your search based on your specific needs and preferences.

- Customer reviews: Check for feedback from other users to gauge the platform's reliability and credibility.

Effective Use of Online Tools

To effectively use online tools for comparing car insurance rates, follow these steps:

- Input your information accurately: Provide correct details about your vehicle, driving history, and coverage needs.

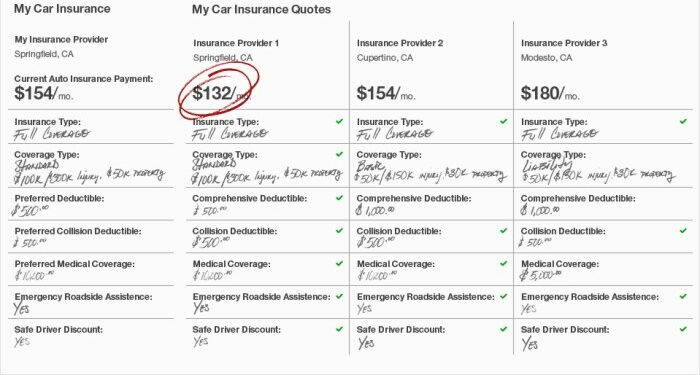

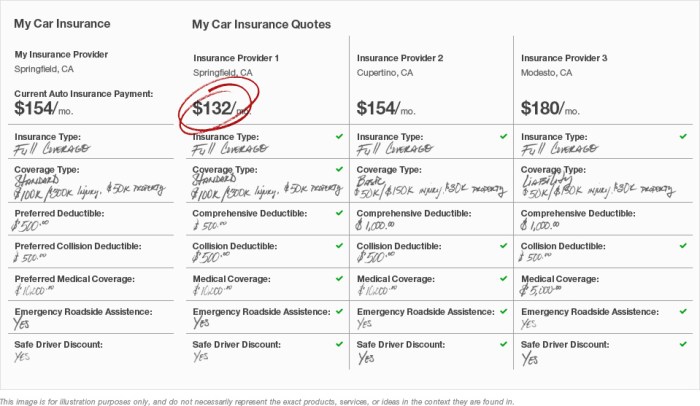

- Compare multiple quotes: Get quotes from at least three different sources to ensure you're getting a comprehensive view of available rates.

- Review coverage details: Pay attention to the coverage options, deductibles, and limits to make an informed decision.

- Seek discounts: Look for any discounts or promotions that could help you save money on your insurance premiums.

Understanding the Impact of Autonomous Vehicles on Insurance Rates

The rise of autonomous vehicles is set to revolutionize the automotive industry, including the way car insurance rates are calculated and offered. As more self-driving cars hit the roads, insurance companies will need to adapt to this new technology and its implications on risk assessment and coverage

This shift from human-driven to autonomous vehicles will lead to a decrease in the number of accidents, ultimately affecting insurance rates. With fewer accidents, insurance companies may adjust their premium rates to reflect the decreased risk associated with autonomous vehicles.

Impact on Insurance Policies

- Insurance policies for autonomous vehicles may focus more on the technology and software used in these vehicles rather than individual driving records.

- There could be a shift towards product liability insurance for manufacturers of autonomous vehicles to cover any software malfunctions or technical failures.

- Policy coverage for accidents involving autonomous vehicles may need to address the complexities of determining liability between the vehicle owner, manufacturer, and software developers.

Differences in Insurance Premiums

- Autonomous vehicles may initially have higher insurance premiums due to the cost of repairing or replacing advanced technology in these vehicles.

- Over time, as the technology becomes more widespread and proven to reduce accidents, insurance premiums for autonomous vehicles could decrease compared to traditional vehicles.

- Insurance companies may offer discounts or incentives for owners of autonomous vehicles to encourage the adoption of this technology and promote safer driving practices.

Strategies for Negotiating Competitive Car Insurance Rates

When it comes to negotiating competitive car insurance rates, there are several strategies that can help you secure better deals and lower premiums. By understanding how insurance providers operate and leveraging your personal information, you can work towards obtaining favorable rates that suit your needs and budget.

Leveraging Personal Information to Lower Insurance Premiums

- Provide accurate information: Make sure to provide correct and up-to-date information about your driving history, vehicle details, and personal details. Inaccurate information can lead to higher premiums.

- Highlight safety features: If your car is equipped with safety features such as anti-theft devices, airbags, and anti-lock brakes, be sure to mention these to your insurance provider. These features can help lower your insurance premiums.

- Bundle policies: Consider bundling your car insurance with other insurance policies, such as homeowners or renters insurance, to potentially qualify for a multi-policy discount.

- Opt for a higher deductible: By opting for a higher deductible, you may be able to lower your insurance premiums. Just make sure you can afford the deductible in case you need to make a claim.

The Importance of Maintaining a Good Driving Record

- Safe driving habits: Maintaining a good driving record by avoiding accidents and traffic violations can significantly impact your insurance rates. Safe drivers are often rewarded with lower premiums.

- Defensive driving courses: Consider taking a defensive driving course to improve your driving skills and potentially qualify for a discount with your insurance provider.

- Regularly review your policy: Periodically review your insurance policy to ensure you are receiving all the discounts you qualify for based on your driving record and other factors.

Last Word

In conclusion, navigating the realm of car insurance rates in 2025 requires a blend of knowledge, technology, and strategic negotiation. Armed with the insights provided, you are better equipped to secure the best insurance rates tailored to your needs.

Frequently Asked Questions

How can advancements in technology impact insurance rates?

Advancements in technology can lead to more accurate risk assessments, potentially affecting insurance rates positively for safer drivers.

What are some tips for negotiating competitive car insurance rates?

Research different providers, inquire about discounts, and highlight your safe driving record to negotiate better rates.

How will autonomous vehicles affect insurance rates in 2025?

The rise of autonomous vehicles may lead to lower insurance premiums due to decreased accident rates and improved safety features.