Exploring the current landscape of car finance rates, this introduction sets the stage for a comprehensive and insightful discussion, presenting key factors and tips in a manner that is informative and engaging.

The subsequent paragraph will delve deeper into the specifics of the topic, providing valuable insights and analysis.

Factors influencing car finance rates

When it comes to determining car finance rates, several factors come into play. These factors can have a significant impact on the interest rates offered to borrowers, ultimately affecting the overall cost of financing a vehicle. Let's explore some key factors influencing car finance rates.

Economic conditions affect car finance rates

Economic conditions play a crucial role in determining car finance rates. When the economy is doing well, with low unemployment rates and strong consumer confidence, interest rates tend to be lower. On the other hand, during economic downturns or periods of uncertainty, interest rates may rise as lenders seek to mitigate risks associated with lending.

For example, during the 2008 financial crisis, interest rates increased significantly, making it more expensive for consumers to finance a vehicle.

Credit scores impact the interest rates

Credit scores are another major factor that influences car finance rates. Borrowers with higher credit scores are generally seen as less risky by lenders and are more likely to qualify for lower interest rates. Conversely, individuals with lower credit scores may face higher interest rates or even struggle to secure financing at all.

For instance, someone with an excellent credit score of 800+ may be offered an interest rate of around 3%, while a borrower with a poor credit score of 500 or below could face rates of 15% or higher.

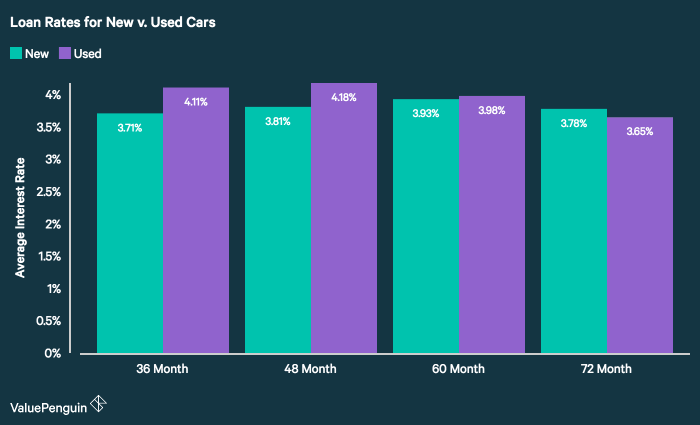

Role of loan terms in determining the average rates

The terms of the loan, such as the duration of the repayment period, also play a significant role in determining the average car finance rates. Typically, longer loan terms result in higher interest rates, as lenders are taking on more risk over an extended period.

Shorter loan terms, on the other hand, often come with lower interest rates but may require higher monthly payments. For example, a 60-month loan may have an average interest rate of 4%, while a 36-month loan could have a rate of 3%.

Current average car finance rates

When looking to finance a car, it's essential to understand the current average interest rates to make an informed decision. Let's explore the typical range of rates for new and used car loans, as well as the differences between rates offered by banks and credit unions.

Interest rates for new car loans

- On average, interest rates for new car loans typically range from 3% to 4.5%.

- Banks may offer slightly higher rates compared to credit unions, but it ultimately depends on the borrower's creditworthiness.

- Factors such as the loan term, down payment amount, and the type of vehicle can also influence the interest rate offered.

Average rates for used car financing

- Interest rates for used car financing are slightly higher than those for new cars, ranging from 4% to 6% on average.

- Lenders may consider the age and mileage of the vehicle, as well as the borrower's credit score, when determining the interest rate.

- Credit unions may offer more competitive rates for used car loans compared to traditional banks.

Comparison of rates offered by banks and credit unions

- Banks generally have stricter lending criteria, which can result in higher interest rates for borrowers with less-than-perfect credit.

- Credit unions, on the other hand, are known for offering lower interest rates and more personalized service to their members.

- It's important to shop around and compare rates from both banks and credit unions to secure the best deal on your car loan.

Tips for getting the best car finance rates

When it comes to securing the best car finance rates, there are several strategies you can employ to ensure you get a good deal. From shopping around for rates to improving your credit score, these tips can help you save money in the long run.

Importance of shopping around for rates

One of the most crucial steps in getting the best car finance rates is to shop around and compare offers from different lenders

Designing a strategy for negotiating lower interest rates

When negotiating with lenders, be prepared to leverage any competitive offers you have received from other institutions. Use this information to negotiate for lower interest rates or better loan terms. Remember that lenders are often willing to negotiate, especially if you have a strong credit history or are a loyal customer.

Steps to improve credit score for better rates

One of the most effective ways to secure better car finance rates is to improve your credit score. Start by making timely payments on your existing debts, reducing your credit utilization ratio, and checking your credit report for any errors.

By demonstrating responsible financial behavior, you can boost your credit score and qualify for lower interest rates on your car loan.

Understanding the impact of car finance rates

When it comes to car finance rates, even a small percentage difference can have a significant impact on your monthly payments and the overall cost of your loan. Let's delve deeper into how these rates can affect your finances.

Effect of a 1% difference in interest rate

Even a 1% variance in interest rates can lead to noticeable changes in your monthly payments. For example, on a $20,000 car loan with a 60-month term:

- At 3% interest rate, your monthly payment would be around $361.

- But at 4% interest rate, your monthly payment would increase to about $368.

This seemingly small 1% difference adds up to an extra $7 per month, which translates to an additional $420 over the entire loan term.

Long-term cost differences with varying rates

Securing a low interest rate can lead to substantial savings over the life of your loan. Let's compare the total cost of a $25,000 car loan over a 60-month period at different interest rates:

| Interest Rate | Total Cost |

|---|---|

| 3% | $26,660 |

| 4% | $27,242 |

| 5% | $27,835 |

Advantages of securing a low interest rate

- Lower monthly payments, freeing up more of your budget for other expenses.

- Reduced total cost of the loan, saving you money in the long run.

- Potentially shorter loan terms, allowing you to pay off the car faster.

Summary

Concluding our exploration of car finance rates, this summary encapsulates the main points discussed, leaving readers with a clear understanding and perhaps a newfound perspective on the subject.

Questions Often Asked

What factors influence car finance rates?

Factors such as economic conditions, credit scores, and loan terms play a significant role in determining car finance rates.

What are the current average car finance rates?

On average, interest rates for new car loans fall within a certain range, while used car financing rates may differ. Banks and credit unions also offer varying rates.

How can I get the best car finance rates?

Shopping around for rates, negotiating for lower interest rates, and improving your credit score are key strategies to secure the best car finance rates.

What is the impact of car finance rates on monthly payments?

A 1% difference in interest rate can have a significant impact on monthly payments. Securing a low interest rate can lead to cost savings in the long term.